| Author :

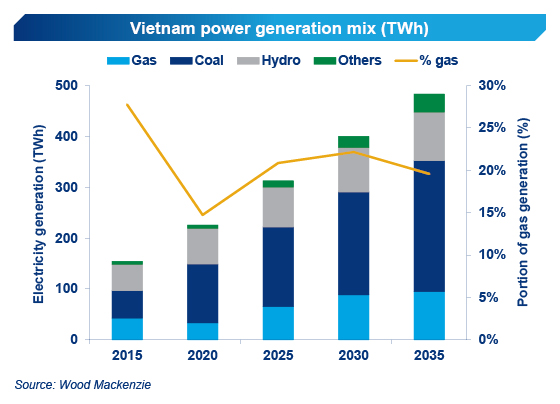

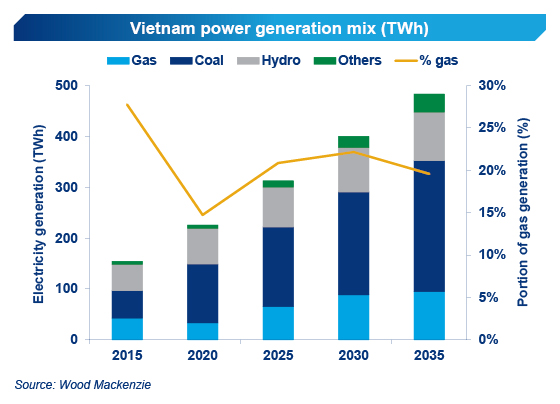

Power demand in Vietnam is set to surge by 7.5% annually from 2015 to 2025 as the country's economy remains one of the fastest-growing in Asia. Coal is increasingly the choice of fuel. We estimate it will top gas and hydro as the biggest power source by 2015, and will increase to more than 50% of Vietnam's power generation mix in the next two decades.

Vietnam's revised 2030 energy master plan, expected by the end of 2015, was slated to detail an increased reliance on imported energy sources and reduce the focus on the development of the country's indigenous gas resources. Much of the growth in coal will be imports from Indonesia.

But with more than 7 trillion cubic feet (tcf) of discovered gas resources, our analysis shows that Vietnam should pursue a more balanced energy portfolio that would provide additional taxation revenues and spur the overdue development of its indigenous gas fields. In addition, Vietnam could avoid an increased reliance on imports and exposure to the volatile international coal market.

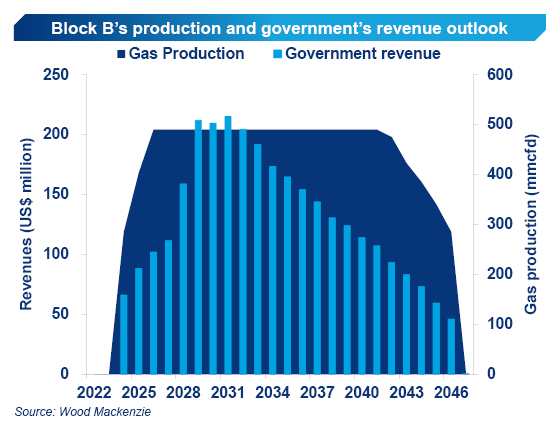

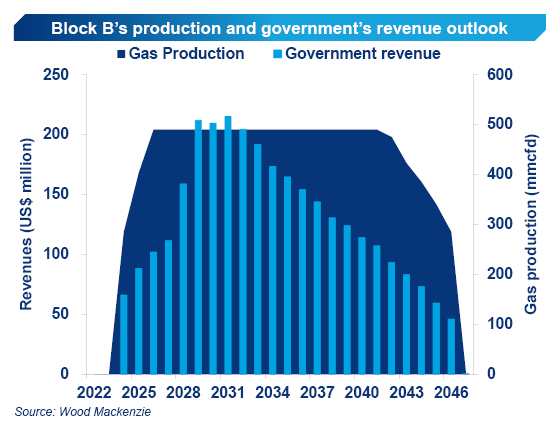

A case in point is Block B, one of the country's largest undeveloped gas resources, located in South Vietnam. PetroVietnam acquired the project from Chevron in mid-2015. Development has stalled there despite the site having been declared commercial 13 years ago.

The case for development remains compelling, with the potential to yield US$3 billion in tax revenues. The project could produce enough gas to meet more than 20% of South Vietnam's gas demand, boosting infrastructure development for future gas projects and offsetting the cost of importing other energy sources.

However, before development proceeds, Vietnam needs to clearly define the role of gas in its future power development plans and provide support for companies to commercially deliver it to the country.

Despite commercial gas reserves and exploration opportunities, a fast-growing Vietnam is increasing its use of coal power. With coal set to become 50% of its energy mix in the near to mid term and an expectation that the country will reduce its focus gas exploration, our analysts look at potential lost revenue and increased volatility.

Power demand in Vietnam is set to surge by 7.5% annually from 2015 to 2025 as the country's economy remains one of the fastest-growing in Asia. Coal is increasingly the choice of fuel. We estimate it will top gas and hydro as the biggest power source by 2015, and will increase to more than 50% of Vietnam's power generation mix in the next two decades.

Vietnam's revised 2030 energy master plan, expected by the end of 2015, was slated to detail an increased reliance on imported energy sources and reduce the focus on the development of the country's indigenous gas resources. Much of the growth in coal will be imports from Indonesia.

But with more than 7 trillion cubic feet (tcf) of discovered gas resources, our analysis shows that Vietnam should pursue a more balanced energy portfolio that would provide additional taxation revenues and spur the overdue development of its indigenous gas fields. In addition, Vietnam could avoid an increased reliance on imports and exposure to the volatile international coal market.

A case in point is Block B, one of the country's largest undeveloped gas resources, located in South Vietnam. PetroVietnam acquired the project from Chevron in mid-2015. Development has stalled there despite the site having been declared commercial 13 years ago.

The case for development remains compelling, with the potential to yield US$3 billion in tax revenues. The project could produce enough gas to meet more than 20% of South Vietnam's gas demand, boosting infrastructure development for future gas projects and offsetting the cost of importing other energy sources.

However, before development proceeds, Vietnam needs to clearly define the role of gas in its future power development plans and provide support for companies to commercially deliver it to the country.

More information, please access: http://www.woodmac.com/analysis/vietnam-gas-coal?utm_source=twitter&utm_medium=social%20media&utm_campaign=wmorganic

.png)