Last year, Vietnam’s capital city, Hanoi, had only 38 days of clean air, according to World Health Organization standards. On average in 2017, air pollution was four times as high as what is deemed acceptable.

But for me, having to put a face mask on my six-year-old daughter most mornings before school because the air is too dirty to breathe is more powerful than the dry language of standards and statistics.

The pollution has several causes, but one of the most potent, and solvable, is burning coal. Harvard University has warned that coal expansion in Vietnam is set to result in 20,000 premature deaths per year.

In much of the world, governments have cracked down on coal power, not just because it fouls the air, but also because it drives climate change.

Financial institutions have followed suit. Last month, HSBC added its name to a list that includes banks such as Royal Bank of Scotland and Deutsche Bank that have strong policies to end financing for new coal-fired power stations.

Remarkably, though, HSBC’s commitment excluded my own country, along with Indonesia and Bangladesh. My daughter, along with rest of Vietnam, it seems, doesn’t have the right to breathe clean air like the rest of the world.

“Too poor, too foreign, let them breathe sulfur dioxide and smog,” the policy might as well read. “They’re only Vietnamese.”

Such lazily racist double standards are made all the more galling by the bank’s attempt to hide its greed behind a thin veneer of condescending concern for the provision of “cheap” power in Vietnam.

The argument that Vietnam needs more coal is nonsense. According to the recently launched Blueprint for Vietnam’s Clean Energy Future, if all the health and environmental costs of coal power are factored in, renewables are already cheaper than coal in Vietnam.

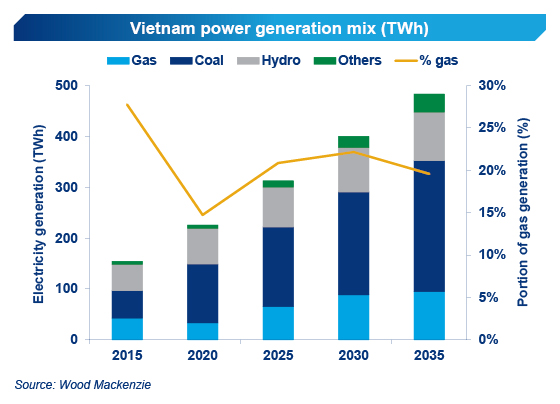

While it is true is that Vietnam and Southeast Asia in general need more power generation to feed their growing economies, the rapid decline in the cost of renewable energy means we no longer have to sacrifice our health for cheaper power.

Pollution aside, pure economics are the main catalyst for clean energy.

Ironically, an unexpected and unnecessary side-effect of this global shift threatens to lock in decades of new coal if action is not taken.

As domestic markets in China, South Korea and the US transition to renewables, these governments are targeting exports to Southeast Asia as a palliative to ease the pain of the waning but still powerful coal industry.

Vietnam needs foreign investment, but we do not need to prop up a dying industry. And we certainly don’t need to do so at the expense of keeping up with the rest of the world with clean, affordable energy.

Sadly, following the flow of international public finance, commercial banks such as HSBC are being lured by the temptation to squeeze the last few extra dollars out of the dirtiest fossil fuel. Even if it means funding the deals everyone wants to keep quiet.

The Long Phu 1 coal plant was so controversial that even the US Export-Import Bank has walked away. Yet HSBC remains lead arranger.

In March, another UK bank, Standard Chartered, was forced from a financial consortium for another Vietnamese coal plant, Nghi Son 2, after non-governmental organizations revealed it had breached the bank’s already low bar for pollution standards.

Despite this embarrassment, Standard Chartered remains involved in financing new coal plants in Southeast Asia.

Like HSBC, it must reconsider whether the limited profits are worth the risks of backing coal deals, especially as the consequences go far beyond reputational damage, or even the impacts on air quality in Hanoi.

As World Bank president Jim Yong Kim warned two years ago, “if Vietnam goes forward with 40 gigawatts of coal, if the entire region implements the coal-based plans right now, I think we are finished.… That would spell disaster for us and our planet.”

This is what is at stake.

By ending all finance to new coal, no matter the country, banks such as HSBC and Standard Chartered can play a critical role in catalyzing the shift to renewable energy.

Today, they remain part of the problem.

Source: http://www.atimes.com/hsbc-standard-chartered-making-a-killing-on-coal-in-se-asia/