“This is what leadership on coal and climate change looks like. Decisions about how the world sources its future energy needs will make or break our ability to contain global warming. Standard Chartered’s policy not only removes a critical source of finance for new coal power plants, but sends a powerful signal to its competitors.

Tuesday 25 September, 2018: Responding to the news that Standard Chartered has ruled out finance for “any new coal-fired power plant projects, including expansions, in any location“, Market Forces Executive Director Julien Vincent said:

“This is what leadership on coal and climate change looks like. Decisions about how the world sources its future energy needs will make or break our ability to contain global warming. Standard Chartered’s policy not only removes a critical source of finance for new coal power plants, but sends a powerful signal to its competitors.

“While Standard Chartered’s banking sector peers have fiddled around the margins with their coal policies, leaving the door open to finance new coal plants of particular types or in particular locations, this is the only policy that recognises the clear, scientific reality: if we’re to avoid runaway climate change we need to stop building new dirty coal power plants.

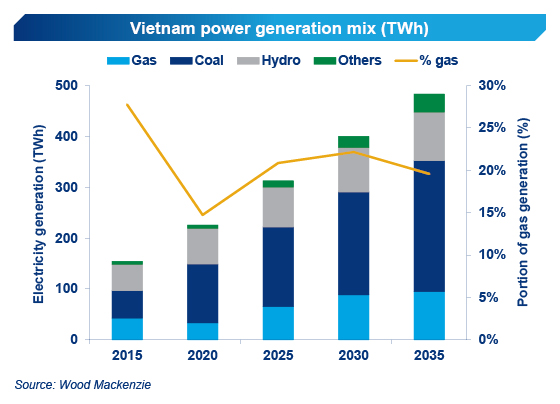

Since 2010, Standard Chartered has loaned at least US$1.8 billion to coal power, including US$820 million to projects that added 10.6 Gigawatts of additional coal power capacity. The bank was also active in syndicates for several new coal power plants prior to the policy update.

“The fact that Standard Chartered was involved in syndicates for three coal power pants in Vietnam prior to this update makes it even more impactful. That’s three dirty coal projects, which would produce almost 700 million tonnes of CO2 per year, that will now need to look elsewhere for finance.”

This year, Singapore’s big three banks (DBS, OCBC and UOB), Japan’s big three banks (MUFG, SMBC and Mizuho) and HSBC have all updated their policies on coal lending, but have failed to completely close the door on what is the single-biggest source of greenhouse gas pollution worldwide.

In August, Market Forces and partner organisations published a full page ad in the Asian Financial times calling on Standard Chartered to rule out new coal worldwide.

Source: https://www.marketforces.org.au

.png)