The new decade has not started on an optimistic note for Asia. After a turbulent 2019, with trade disputes and political unrest unnerving major economies in the region, January 2020 saw the rapid spread of the coronavirus, which has disrupted travel and business. Much uncertainty and anxiety lingers over the impact of the virus but, at some point, normality will resume and the world will have once again to think about a much more dire threat to human existence, climate change.

Accounting for 53% of global emissions, and home to the world’s largest (China) and fastest growing (India and Southeast Asia) emitting economies, Asia’s actions will determine whether we can bend the curve on greenhouse gases and make meaningful progress against climate change. In the last 10 years, we have written extensively about Asia’s gravity-defying rise as the world’s leading investor in clean energy. From 2010 to 2019, the region invested over $1.5 trillion in clean energy or 46% of the global total. According to our New Energy Outlook 2019 (NEO), we expect Asia to invest at least another $1.5 trillion in the decade to 2030.

With lower costs, technological maturity and strong power demand growth, Asia ought to find it easy to choose more wind and solar over coal. But the next $1.5 trillion may not be as easy as the first one – in order for this to happen, companies and governments across the region will need to get ready to make deep changes not only in how the power system is run, but in how corporations and even entire economies are run. These will not be easy choices, but without making them, the clean energy transition in Asia may stall in the coming decade.

In this article, I will discuss three things that companies and governments in Asia will need to get right by 2030 if clean energy is to continue to prevail. These issues have been insufficiently discussed, and the scope and depth of these changes are tough to imagine and grossly underestimated. The Intergovernmental Panel on Climate Change in its 2018 report, Global Warming of 1.5°C, noted that decarbonization required “systems transitions [that] are unprecedented in terms of scale…” A full commitment from all of society is needed. Nowhere is this more accurate than in Asia, especially over the next 10 years.

Unprecedented system changes

At our BNEF Shanghai Summit in December 2019, one breakout session became a surprise hit. It was so overflowing with people that any more bodies in the room would’ve gotten us in trouble with the local fire authorities. The session was not on electric vehicles or batteries, new technologies or recently unearthed investment opportunities. It was a rather dryly titled gathering on power market reform. Our team presented the experience of reforms in Japan and the lessons they hold for China. In any other part of the world, power market reform might not elicit much excitement, but in China, everyone knew that this was the single most important question for whether the country successfully decarbonizes its power sector.

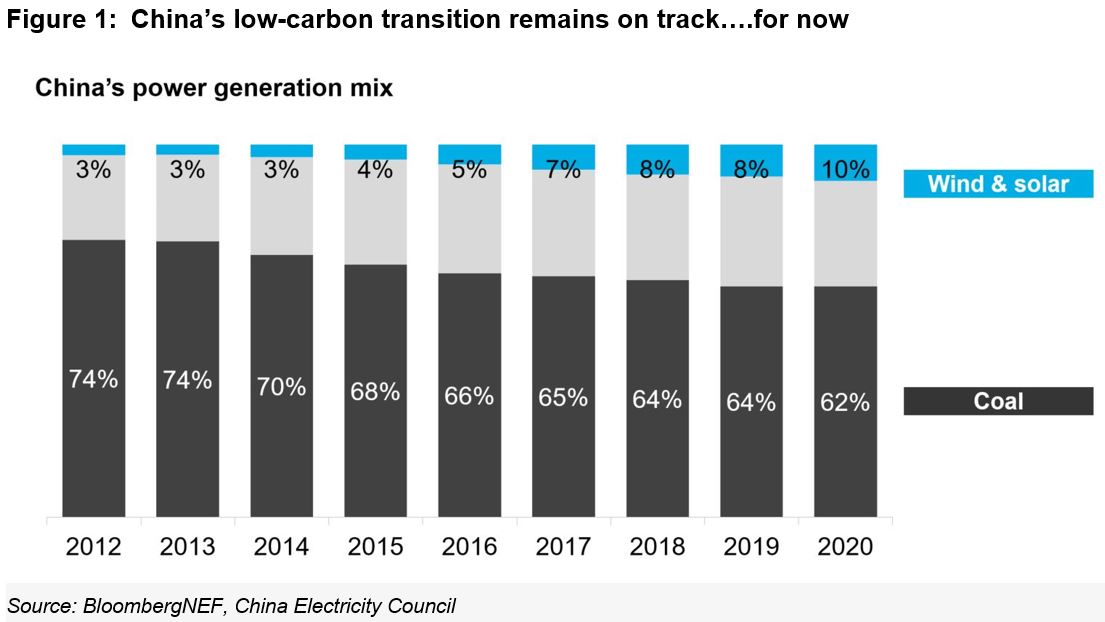

In 2020 China will hit a milestone, where 10% of its electricity will come from wind and solar, a significant achievement for the world’s largest power system. China’s accomplishments in clean energy in the past decade were many, becoming the world’s largest investor in wind and solar and, since 2016, adding more renewable energy capacity each year than fossil fuels. According to NEO 2019, China is projected to achieve 26% of its generation from wind and solar by 2030, and 48% by 2050. These numbers are much larger than they appear if one takes into account that China’s power demand is still increasing. The 26% for China in 2030 is equivalent to about a fourfold increase in terms of terawatt-hours of wind and solar electricity generated from 2020, while the 48% in 2050 would be a sevenfold increase from today.

Achievable? We do think so, if China follows a rational economic method for building its future power system and selects the least-cost technologies to meet its growing demand. But it is not currently following such rules. What policymakers, companies and investors in China do not realize (or appreciate enough), is that to achieve that level of renewable energy build by 2030, deep and significant changes are needed to the way power markets are structured and electricity is bought and sold.

In 2015, China, with much fanfare, kicked off a series of power market reforms intended to change the way its companies invest in power plants and the way electricity is purchased. This meant that instead of regulators telling state-owned companies to build capacity to avoid power shortages, the market should instead give investors price signals on when and what to build. Instead of bureaucrats allocating generation hours to and setting the price for various plants, a wholesale market should allow various power stations to compete to supply the most cost-efficient electricity. Consumers should then benefit from this competition and be allowed to choose who they buy their electricity from, including the option to purchase cheap power from renewable sources.

If this system worked as intended, China would also solve its second (and arguably more important) problem, which is how to pay for wind and solar build without government subsidies. For over 10 years, generous subsidies – in the form of a premium paid to wind and solar producers that is more than double what is given to coal generators – have fueled China’s renewables boom. These subsidies have become unsustainable in recent years and also increasingly difficult to justify, given the rapid cost declines of wind and solar. The government now wants to phase these subsidies out completely in the next 1-2 years.

Up till now, progress on both efforts has been slow. Less than 30% of electricity produced in China was sold via deregulated mechanisms in 2019, meaning power sold at a price other than that mandated by the government for that technology, far less than the 70%-plus aim for post-2020. On the renewable subsidies side, we estimate that only about 18% of solar and 2% of wind were built without feed-in tariff premiums in 2019.

But where electricity has been sold at deregulated rates, we have seen healthy discounts – coal power was sold on average 7% below regulated rates, while wind achieved a 23% discount. This meant that power can be procured at a cheaper rate by retailers or directly by some large factories and commercial sites. “Subsidy-free” wind and solar, though still small, has demonstrated its viability, meaning that even without generous subsidies, China’s large domestic wind and solar markets will not collapse.

China’s regulators realize that these reforms are necessary, as the current approach is no longer viable in the age of the energy transition and a maturing economy that is less dependent on power-hungry industries. But to progress further, China’s policymakers and companies will have to be prepared to start dealing with the challenges that many other liberalized power markets have been wrestling with for years – namely “duck curves”, declining realized power prices for all, reliability issues, price instability for consumers. Without government orders, dispatch or price guarantees, large state-owned power producers may decide that they can no longer build or profitably operate coal power in the face of cheap renewable energy – the 148GW of planned coal capacity may never happen. In the current environment, as the Chinese government struggles against economic headwinds, leaving power prices to the mercies of the market may be a step too far.

In 2020, India will also hit the same milestone where 11% of its electricity will come from wind and solar. Although the country has a more deregulated (and arguably more open and competitive) power system than China, economic and structural concerns also weigh heavily and hold back its potential to deploy more renewable energy.

Like China, India has also made tremendous progress in the last 10 years. It has built more renewable energy than coal every year since 2017 and has successfully deployed the world’s cheapest solar energy through competitive auctions, demonstrating that green power is affordable for developing nations as well.

Our NEO 2019 also highlights India’s vast future potential – the model shows it achieving 26% wind and solar by 2030, and 55% by 2050. By 2050, India will overtake the U.S. to become the world’s second-largest power system. This means that the 55% wind and solar by 2050 is equal to a 17.5-fold increase in terms of terawatt hours from 2020.

But for now, India is moving in the opposite direction – our team has cut the country’s forecast wind and solar capacity between 2020 and 2023 by over 10GW because of a slew of challenges currently faced by the industry. The government’s ambitious target for 175GW of wind and solar by 2022 now looks impossible to reach – at the end of 2019, India had just under 80GW of the two technologies.

At the heart of India’s challenges are its power distribution companies (or “discoms”), which are responsible for the supply and distribution of electricity to consumers. Unable to make a profit or to break even from selling power, many discoms are under severe financial and operational stress, and relying on government bailouts to survive. Financially distressed discoms in turn threaten the banks that have supported them, creating a drag on the local economy overall. Because state regulators set power prices (and have an interest in keeping these low, especially for residents and farmers, for socio-economic and political reasons), discoms have no ability to set a price that can help them break even. To make matters worse, they often lack the resources to collect electricity fees from their existing customers. As a result, most of India’s discoms simply cannot afford to purchase enough electricity to meet growing demand, even if that electricity comes from some of the cheapest solar and wind in the world.

The fact that the costs of wind and solar are decreasing relentlessly only makes matters worse – some discoms reneged on their power purchase agreements (PPAs), electing to renegotiate for a better price when costs come down. In Andhra Pradesh, the state government threatened to renegotiate or cancel the renewable energy PPAs in the state that did not match the low tariffs in other parts of the country, arguing that high tariffs were against the public interest and its distribution companies could not afford to pay for the expensive power. Intervention by courts and appeals bodies eventually forced the state government to back down, but the damage was already done, investors were unnerved and thought twice about putting more money into wind or solar.

The woe of the discoms is widely known by those in the renewable energy industry and widely cited as a barrier toward more deployment in India. When Prime Minister Narendra Modi was first elected in 2014, he promised discom reform. In January 2020, he promised it again and set specific goals for the privatization of discoms as well as for reducing their losses from electricity sales. Unless the situation with discoms is resolved, India will struggle to quadruple its renewable energy generation by 2030. But doing so will be painful – the discoms will need to be privatized and turned into profit-making entities. That results in the loss of jobs. Then the government has to allow these newly privatized discoms to charge a fair price for their electricity, which will mean power prices will likely go up for India’s consumers, something that will have political and economic consequences. Is India ready for this?

The role of cities

During a recent trip to Bangkok late last year, a client at a large company requested we give a presentation to help inform his colleagues on what the energy transition means for Southeast Asia. He warned us beforehand that the audience would be diverse, meaning that not everyone there was familiar with clean energy or believed in its future prospects. Despite the tropical sunshine outside, the audience, dressed mostly in suits and sweaters, were freezing – the air conditioning in the room was on full.

The client was right as it didn’t take long for me to receive my first skeptical question, which was something to the tune of: “Are you sure we can build that much solar in the future? We have no land in Bangkok, do you know how expensive real estate is here?” I replied that while land concerns are common across densely populated countries in Asia, and that indeed urban real estate is expensive, they are not a barrier to renewable energy deployment. The latter is not necessarily more land-intensive than other infrastructure projects and does not need to be deployed on prime lots in cities.

However, the question and the entire experience of that trip did make me think about one important factor in the energy transition in Asia – the role of cities, especially of those in emerging countries. Asia is rapidly urbanizing, with its cities becoming concentrations not only of population, but also of economic activity and therefore emissions. According to the United Nations, Asia’s urbanization rate is actually lower than that of other regions, standing at just over 50%, but is growing rapidly, and the continent’s larger population means that more than half of the world’s 4.2 billion urban residents currently live in Asian cities. Furthermore, Asia’s urban areas are far larger and more concentrated than those on other continents – led by the world’s three largest urban areas by population – Tokyo, New Delhi and Shanghai. In the case of Bangkok, the city also serves as the center of Thailand’s economy, accounting for about 44% of national GDP. How Asia manages the energy footprint of its cities in the coming decade will determine whether we can bend the curve on emissions not only in power, but also in transport, industry and buildings.

The growth of Asian megacities also raises important questions about quality of life, since larger cities mean worse air pollution and transport congestion. Attempts to resolve both have already had an impact on the energy transition, as we have seen in China, where large-scale coal-to-gas switching for municipal heating has led to a surge in gas consumption, and restrictions on internal combustion engine vehicles have resulted in more than half of the world’s electric vehicles being deployed on Chinese streets. Both of these efforts had a noticeable impact on improving air quality in recent years. In 2019, Beijing’s average concentration of PM2.5 – the most harmful small particles and a key indicator of air pollution – dropped to less than half of their levels in 2013 and the city was removed from the list of the world’s 200 most polluted cities.

At the same time that Beijing saw noticeable improvements, Bangkok and Delhi battled with growing concerns about air pollution, amid protests and government pledges for action. How will rapidly urbanizing Southeast Asia and India deal with growing worries about pollution and will this also have an impact on their energy and transport choices?

Like China, cities in India and Southeast Asia view the growing number of cars, as well as two- and three-wheeler transport (mopeds and tuk tuks) that rely mostly on diesel, as a major source of pollution. More people mean more trips in these vehicles, which results in more congestion and emissions. But unlike China, countries in the warmer climates of southern Asia do not use coal for heating, but instead rely on air conditioners for cooling, which leads to greater electricity demand. Let’s look at the impact of the two separately.

First on transport, BNEF forecasts that by the end of 2020, there will be about 10 million electric vehicles on the road, the vast majority of them in China, Europe and North America, with negligible numbers in India or Southeast Asia. While companies and governments across India and Southeast Asia are very interested in business opportunities associated with electric vehicles and battery manufacturing, the reality is that most EVs remain out of reach for emerging world consumers. The average cost in Thailand of an internal combustion engine sedan made by a Japanese or Korean manufacturer is around $17,000, while the price of a Nissan Leaf is about $64,600. Our advanced transport team expects that with declining battery costs, electric vehicles will start to reach “sticker price parity” with internal combustion vehicles in the mid-2020s in major car markets such as those in China, Europe and the U.S. But for Southeast Asia or India, the price gap is too big to close in the near term.

Despite this, the electrification of transport will still have a role in developing Asia. It will just come in two or three wheels instead of four, and in shared fleets instead of private car ownership. In India, two-wheelers accounted for over 80% of all vehicle sales between 2018 and 2019 and electric two-wheeler sales more than quadrupled between 2016 and 2018. Three-wheel tuk tuks, which are often used as taxis in Indian cities, have lower costs of ownership with electric, than with fossil fuel, drivetrains – when driven for longer distances. Electric three-wheeler sales have surged since 2016 on the back of government support. Our team in India and Southeast Asia also forecasts that while demand for passenger vehicle miles traveled will increase dramatically in the next 10 years, thanks to urbanization and economic growth, more than 40% of this demand could be met by shared mobility – in other words, buses, taxis or ride-hailing apps.

These are all positive trends and show that emerging Asia has a path toward electrification of transport that runs through tuk tuks instead of Teslas. But the task of meeting growing urban transportation demand, without exponentially increasing air pollution in Asia’s cities, will be an extremely challenging one. Bangkok’s population, currently at 10 million, is expected to surge to more than 15 million by 2030. Neighboring Jakarta, which has also experienced air pollution and even worse congestion, is predicted to become the world’s largest city by 2030, with a population of over 35 million.

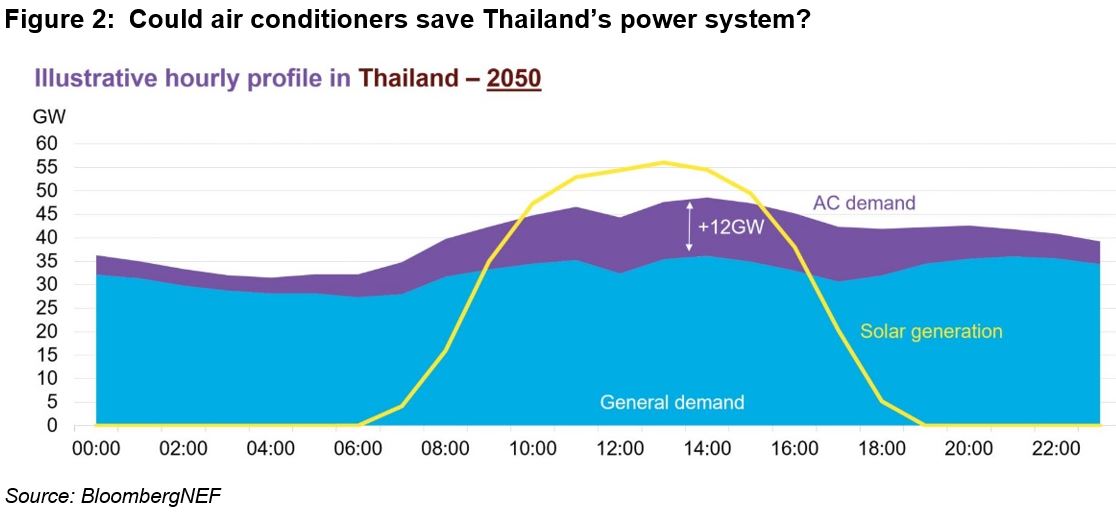

Air conditioning demand in Southeast Asia will also surge along with growing populations and urbanization. Between 2018 and 2050, our team forecasts that power demand in the region will grow by 152%, while electricity demand from air conditioning will surge by 493%. Less than 30% of households in Thailand and 10% of households in Indonesia currently own an air conditioning unit. By 2050, over 60% of households across Southeast Asia will have air conditioners, accounting for 26% of gross electricity demand.

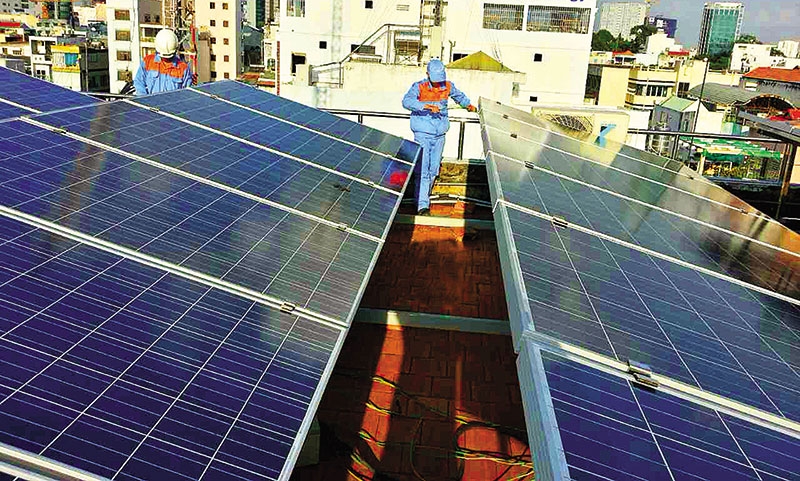

The rise in air conditioning use will certainly present challenges for grid operators and power companies in Southeast Asia, but it will also be an opportunity. Air conditioner use is at its highest when it is hot during the day, which means that power demand peaks during the noon and afternoon hours. This corresponds perfectly with solar generation, also at its highest during the sunny noon and afternoon hours. Our NEO 2019 forecasts a high amount of solar investment in Southeast Asia through 2050 – more than 60% of the $611 billion invested in generation in the region will go into solar, both utility and small-scale. Clearly there is an opportunity to match the two together to help balance the system and power air conditioners with a source of cheap and clean electricity during the middle of the day.

But this again will only happen if policymakers and governments in these countries prepare for it and recognize the scale of what is needed. Air conditioners will radically alter the demand profiles of power systems across Southeast Asia. That means investment will be needed in distribution grids in these cities, and more data and software will be required to manage all of this. If Bangkok or Jakarta wants to be ready for the next 10 years, it needs to start thinking about, and investing in, this now.

Building a new global brand

On September 22, 2019, the eve of the UN Climate Action Summit in New York, Japan’s new environment minister, Shinjiro Koizumi, pledged to mobilize young people in his country by making the fight against climate change “sexy” and “fun”. At only 38 years old, Koizumi, the telegenic son of a former prime minister, is considered a rising star in Japanese politics, but his comment in New York (considered his diplomatic debut on the world stage) was met with skepticism and ridicule back home.

The rest of the Japanese government, which was under criticism from other countries ahead of the UN Summit for continuing to build coal power plants at home and abroad, appeared in no mood for Koizumi’s remarks. An official comment approved by the cabinet of Prime Minister Shinzo Abe dryly noted afterward that Koizumi’s use of the word “sexy” was “difficult to accurately translate into Japanese” – perhaps a polite way of saying that the remark was nonsense.

But despite this rebuttal, Koizumi was on to something: 2019 was the year that sustainability became in vogue for corporate Japan. At the end of last year, 30 Japanese firms had become members of the RE100 – a group that has pledged to source 100% of electricity for their operations from renewable sources. This is more than any other country in Asia and the third-most in the world behind only the United States and the U.K. Similarly, Japanese firms also topped global rankings in pledging to support the Taskforce for Climate Related Financial Disclosures, with membership in the TCFD increasing by more than fivefold in 2019, to 230. The TCFD requires its supporting companies to disclose the climate-related opportunities and risks they face and their plans to mitigate them. Eight-six Japanese firms have also committed to, or set targets for, Science Based Targets (SBT), which are goals adopted by companies to reduce their greenhouse gas emissions to limit global warming to below 2 degrees Celsius. All three groups – the RE100, TCFD and SBT – have become important measures of corporate sustainability and badges of honor worn by companies that have joined them.

The recent surge of interest in corporate sustainability in Japan was the result of several factors coming together. First, a large number of Japanese companies are suppliers to technology firms in the U.S., which have been early members and strong supporters of the RE100. U.S. tech firms such as Apple, Google and Microsoft have increasingly pressurized their Asia based supply chains to source renewable energy. As of January 2020, Japanese suppliers derived $72.5 billion annually from RE100 members based outside of Japan, second in the world only to firms from Taiwan. Second, in December 2018, Japan’s largest public investor, the Government Pension Investment Fund (GPIF), became a supporter of the TCFD, which then triggered a wave of other Japanese companies to follow. This reached a crest in June 2019, when Japan hosted the G20 Summit in Osaka, providing an opportunity for government and corporations to showcase their sustainability credentials.

At the start of 2020, corporate Japan had clearly put itself on the map with its sustainability pledges, but the question has become, now what? Indeed, it was one thing to make pledges and set targets, but quite another to implement them. A look at Japan’s RE100 members illustrates this. The RE100 requires its members to set a target year for using 100% renewable energy to power its operations. Of the 30 Japanese members, nearly all of them have set a target to achieve this in 2050, with only a few setting interim goals for 2030 or 2040. Furthermore, most have announced plans to procure renewable energy for their operations in countries outside of Japan, with no comment on how (or when) they would do this at home. In contrast, most RE100 members in the U.S. or Europe are aiming to achieve their goals well before 2050, with a handful of firms having already achieved 100% renewable energy use, or mapped out a detailed plan on how to achieve this.

But it would be unfair to blame Japanese firms for setting goals that are distant in time and space. Corporate procurement remains difficult if not impossible in Japan and in most countries in Asia. This is because of regulation – most countries in Asia simply do not allow large users of electricity to negotiate power purchase agreements with renewable energy suppliers, or even to choose from whom, or what sources of electricity, to buy. To enable Japanese firms to reach their goals, significant changes to power systems would have to take place not only in Japan, but across all countries where these companies operate, many of which are emerging markets across Asia.

Aside from the RE100, TCFD disclosure requirements or SBT emission reduction goals may be even harder to achieve. Significant changes to the way companies disclose their operational and strategic plans are required to meet TCFD standards – often it means an honest assessment that a firm is significantly exposed to climate-related risks, including large financial losses. Investors will not like it, but to be fair, few companies can be fully prepared for a major weather event, which is becoming increasingly likely with warming temperatures. Meanwhile, the emission reduction goals of the SBT relate to the entire emissions footprint of a company, not only its electricity use. This requires a holistic assessment of the carbon footprint of its entire operational supply chain, including areas that a company may not directly control. No matter where a firm is headquartered, it will likely need to undergo a dramatic transformation in the way it is governed and operated in order to meet these pledges. Like the power market reforms required in China or India, is corporate Japan really ready for this kind of change?

It is not a surprise that corporate Japan has begun to embrace sustainability at a time when there is growing awareness of climate issues amongst governments, companies and consumers around the world. Within Asia, Japanese firms have long been some of the most global and consumer-facing. They rely on operations in many countries around the world and many have been household names in both developed and developing markets for decades. Since the days when the first Toyota Corollas or Sony Walkmans were sold outside of Japan, building a global brand and following consumer preferences was always a key priority. At the start of 2020, sustainability is now important for consumers and branding. Over the next 10 years, we will see whether the companies that have made these pledges are able to follow through with successful implementation strategies and whether they inspire other firms in Asia to follow.

Much like their Japanese peers first attempted to do 30 or 40 years ago, Chinese companies are now seeking to build global brands and international businesses. So far they have faced tremendous headwinds – an increasingly unfavorable trade environment with a dash of geopolitical tension for good measure – not entirely unlike what Japanese corporations faced in the 1970s or 1980s. But sustainability cuts across national boundaries and, to achieve a 2-degree world, every company everywhere has to adopt these goals. Perhaps this represents a unique opportunity to build a new global brand.

Source: BloombergNEF - Author: Justin Wu, Head of Asia-Pacific, BloombergNEF

.png)